Accounting, often referred to as the “language of business,” plays a foundational role in nearly every facet of the corporate landscape. It’s not merely about tracking numbers or balancing books; it’s about understanding the pulse of a business, evaluating its health, and making informed decisions that drive growth and stability.

Here’s an overview of the importance of accounting knowledge in the business world:

Financial Health Assessment: At its core, accounting provides a snapshot of a company’s financial health. Income statements, balance sheets, and cash flow statements, among other reports, offer insights into the company’s profitability, liquidity, and solvency.

Informed Decision Making: Businesses make countless decisions daily, from investment choices to hiring. Proper accounting ensures that these decisions are backed by solid financial data, reducing risks and optimizing opportunities.

Budgeting and Forecasting: Through accurate accounting, businesses can set realistic budgets and forecast future financial needs, ensuring sufficient funds for operations, expansions, or emergencies.

Just to let you know

Sign up for a free OnlineExamMaker account to create an interactive online quiz in minutes – automatic grading & mobile friendly.

Why accounting knowledge assessments are important?

Accounting knowledge assessments, whether they’re conducted during the hiring process, as part of ongoing training, or during professional certification, play a crucial role in ensuring the efficiency and reliability of a business’s financial operations.

Here are some compelling reasons why these assessments are so pivotal:

Maintaining Accurate Financial Records: The accuracy of financial data is paramount in business. Mistakes can lead to misinformed decisions, financial losses, and legal troubles. By assessing accounting knowledge regularly, businesses can ensure their staff possess the expertise needed to maintain precise records.

Enhancing Decision Making: The better trained and informed an accounting team is, the more accurately they can portray the company’s financial health. Accurate financial data is the bedrock of effective decision-making in any business.

Regulatory Compliance: With ever-evolving accounting standards and regulations, it’s essential to ensure that accountants are up-to-date with the latest rules. Regular assessments can pinpoint gaps in knowledge about new laws or changes to existing ones.

Professional Development: Knowledge assessments can identify areas where professional development is needed. This allows businesses to tailor training programs effectively and helps accountants further their careers.

Risk Mitigation: Inaccurate accounting can expose a business to various risks, from financial penalties to reputational damage. Regular assessments ensure that accounting staff can spot and rectify potential issues before they escalate.

Building Stakeholder Trust: Investors, creditors, and other stakeholders rely on accurate financial reporting to make decisions related to the company. Demonstrating a commitment to maintaining a high standard of accounting knowledge can bolster stakeholder confidence.

Optimizing Recruitment: For businesses in the process of hiring, accounting assessments can help filter candidates, ensuring that only the most knowledgeable and capable professionals are chosen for vital roles.

In this article, we will introduce 8 user-friendly accounting knowledge assessment software, each tool contains auto grading system that will empower your training.

- 1. OnlineExamMaker

- 2. QuickBooks

- 3. Wiley CPAexcel

- 4. AccountingCoach PRO

- 5. Surgent

- 6. Gleim

- 7. CCH Learning

- 8. Test Invite

1. OnlineExamMaker

OnlineExamMaker is a versatile online quiz tool designed for creating quizzes, tests, and exams across various subjects, including finance and accounting. Features include customizable templates, diverse question types (multiple-choice, fill-in-the-blanks, etc.), automated grading, detailed analytics, and integrations with tools like MailChimp and Trello. Its intuitive interface ensures both novices and professionals can design assessments easily.

Online proctoring technologies for cheating prevention

One of OnlineExamMaker’s key strengths is its “Live Pop-In” feature, which enables live proctors to intervene if any potential cheating behaviors are detected. Proctors can send automated warnings or even pause the exam if necessary, maintaining a secure testing environment while respecting student privacy.

Pros:

User-friendly interface.

Customizable templates aiding in quiz creation.

Detailed analytics for performance assessment.

Integration with other software and tools.

Mobile optimized.

Cons:

Advanced features might have a learning curve for beginners.

Create Your Next Quiz/Exam with OnlineExamMaker

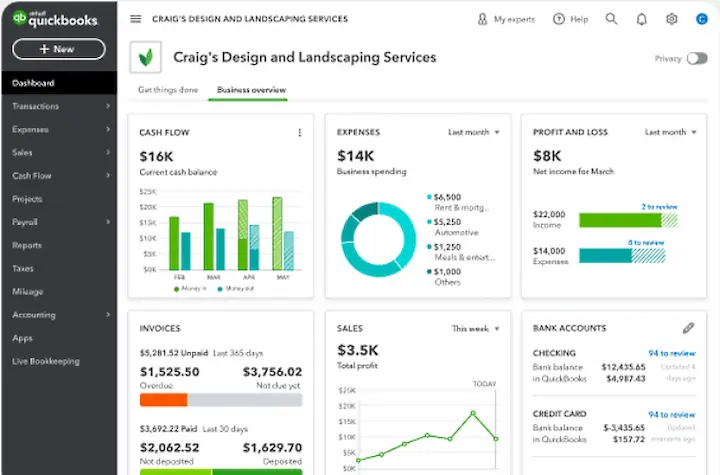

2. QuickBooks

QuickBooks ProAdvisor Certification ensures proficiency in QuickBooks software. It encompasses modules on setup, banking, expenses, sales, and reporting, along with practice scenarios and an assessment.

Best Suited For:

Accountants, bookkeepers, and professionals seeking validation for QuickBooks expertise.

Pros:

• Widely recognized.

• Comprehensive training materials.

Cons:

• Limited to QuickBooks software.

• Needs periodic recertification.

3. Wiley CPAexcel

Wiley CPAexcel is a comprehensive CPA exam preparation tool renowned for its rigorous content and effective study aids. It provides detailed video lectures, practice questions, simulations, and mock exams. A standout feature is the “Bite-Sized Lessons” design, which divides vast subjects into manageable portions. The platform offers continuous content updates to remain in alignment with AICPA standards. There’s also a dashboard for tracking progress and performance metrics.

Best Suited For:

CPA candidates.

Pros:

Extensive question banks and mock exams.

Regular content updates to reflect the latest AICPA changes.

Bite-sized lessons enhance retention and ease of study.

Offers mobile app for on-the-go learning.

Cons:

Premium pricing, although the content justifies the cost.

The sheer volume of materials can be overwhelming for some.

Requires consistent and dedicated effort for the best results.

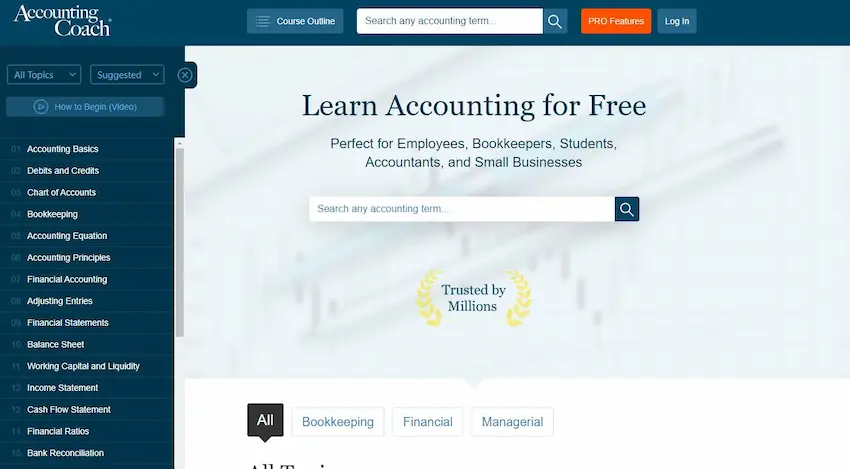

4. AccountingCoach PRO

AccountingCoach PRO provides foundational training in accounting and bookkeeping, delivering learning via quizzes, flashcards, and cheat sheets, ensuring concepts are understood.

Best Suited For:

Students and small business owners.

Pros:

• Affordable.

• Covers fundamental accounting concepts.

Cons:

• Not for advanced users.

• No formal certification.

5. Surgent

Surgent offers a personalized study approach with adaptive technology, focusing on weak areas, and maximizing study efficiency. It provides real-time performance metrics and a vast question bank.

Best Suited For:

CPA exam candidates.

Pros:

• Tailored study plans.

• Quick study sessions.

Cons:

• Expensive.

• User interface less polished than rivals.

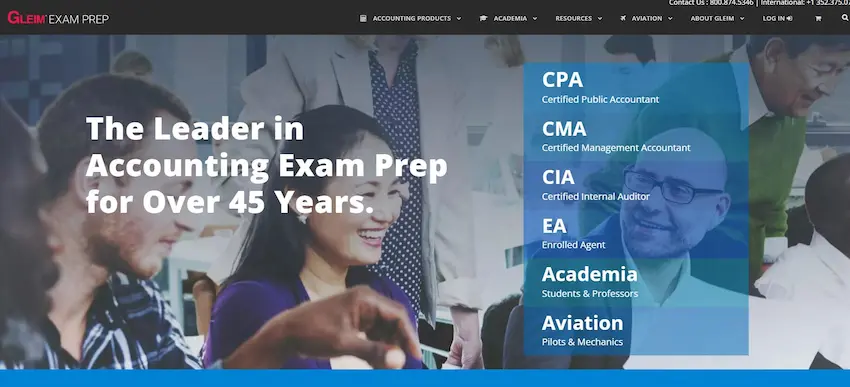

6. Gleim

Gleim offers an exhaustive review of CPA exam topics, providing detailed answer explanations, performance analytics, and simulated exams replicating the real test experience.

Best Suited For:

CPA candidates.

Pros:

• Detailed feedback.

• Large question bank.

Cons:

• Slightly dated interface.

• Premium pricing.

7. CCH Learning

CCH Learning is a platform designed to provide training and continuing professional development (CPD) for accounting, legal, and business professionals. With a vast range of webinars, on-demand courses, and workshops, it covers essential areas like taxation, accounting standards, audit, corporate law, and more. Experts from various fields lead the sessions, ensuring quality content and current industry insights. The platform also provides tools for tracking and managing CPD hours, crucial for professionals maintaining their certifications.

Who It’s Best Suited For:

Accountants, tax consultants, auditors, legal professionals, and any business experts who wish to stay updated, upskill, or fulfill their CPD requirements.

Pros:

• Wide variety of topics catering to multiple professionals.

• Regular updates to reflect industry changes.

• On-demand courses provide flexibility.

• Expert-led webinars ensure high-quality content.

Cons:

• Some courses may come at a premium price.

• Course quality can vary, given the extensive range.

• Geared more toward regions where CCH has a strong presence, possibly leaving out specific regional content.

8. Test Invite

Test Invite is an online assessment platform that allows companies to conduct secure and customizable tests for finance & accounting assessment, recruitment, training, and examinations. It offers features like timed tests, video recording for remote proctoring, advanced question types, and automatic grading. The platform ensures secure exam environments by locking down the browser during testing to prevent cheating

Who It’s Best Suited For:

Businesses and educational institutions looking for a secure and customizable accounting knowledge assessment platform and remote assessments.

Pros:

• Strong security features including browser lockdown.

• Offers remote proctoring via video monitoring.

• Wide variety of question types.

• User-friendly dashboard and analytics.

Cons:

• Interface might be a bit daunting for first-time users.

• Video proctoring might require good internet bandwidth.

• Subscription pricing might be steep for small businesses or individual educators.