For any insurance company, the right agent is crucially important when it comes to hiring. That is why a good candidate should have not only technical knowledge but also the required interpersonal skills in serving clients. To make sure you hire a good candidate, it is also important to be assured of their proficiency and knowledge of skills.

In the article below, we will learn what assessment of the insurance agent’s skills is, which skills this position requires, and how to create this assessment with OnlineExamMaker.

- What Is An Insurance Agent Skills Assessment?

- What Soft and Hard Skills Are Important for Insurance Agents?

- How to Make An Insurance Agent Skills Assessment Using OnlineExamMaker?

What Is An Insurance Agent Skills Assessment?

Insurance agent skills assessment is the procedure to analyze candidates based on their ability, knowledge, and traits pertinent to the job requirement. It assists employers in making decisions on whether the candidate holds the requisite expertise and people skills necessary for the successful performance of duties.

The usual domains include these.

● Knowledge of insurance products and policies.

● Understanding of industry regulations and compliance.

● Customer service and sales skills.

● Problem-solving skills and attention to detail.

On the other hand, assessment ensures that you get a candidate who can efficiently deal with both the technical aspects of the job and clients.

What Soft and Hard Skills Are Important for Insurance Agents?

Insurance agents require both hard and soft skills to become successful in their field. Here’s a breakdown of these essential skills.

Hard Skills (Technical Skills)

Product knowledge

To sell insurance, a person needs substantial product knowledge in various types of insurance policies, such as auto, home, life, and health insurance, which have to be explained to the clients.

Risk assessment

Agents should be able to assess risk and recommend suitable coverage for clients’ needs.

Regulatory knowledge

A proper understanding of industry regulations ensures that all policies and transactions are well within the domain of the law.

Just so you know

With OnlineExamMaker quiz software, you can create & share professional insurance agent skills assessments easily.

Claims handling

Claims handling involves the knowledge of the claims process to guide the client in filing and follow-up on claims.

Financial acumen

The insurance agent should understand how premiums are calculated and how different coverage options drive the price.

Soft Skills (Interpersonal Skills)

Communication skills

Agents should be articulate and communicate in a professional manner, being able to explain intricate policies in an understandable way to the clients.

Sales skills

It is essential to be convincing; agents need to know the art of selling insurance policies. They must explain to the customers what their needs are and what type of coverage options will suit them.

Customer service

Representatives should be affable and responsive to customer needs, building long-term relationships on the basis of trust.

Attention to details

In insurance, everything is about the details. An agent should be detail-oriented with regard to dealing with papers and policy information to avoid any sort of mistake.

How to Make An Insurance Agent Skills Assessment Using OnlineExamMaker?

OnlineExamMaker can help you with a custom online assessment to check on the effectiveness of candidates applying to be insurance agents.

Create Your Next Quiz/Exam with OnlineExamMaker

Here’s how you can do it!

Step 1: Create insurance skills questions

OnlineExamMaker allows you to create multiple-choice, true/false, and scenario-based questions. Sample of questions may be given as:

Multiple Choice:

Which of the following is NOT usually covered under a standard homeowner’s insurance policy?

a) Fire damage

b) Damage due to flooding

c) Theft

d) Liability

Scenario-based:

A customer is perplexed as to why their auto insurance premium has increased. Explain to the customer the factors that come into play that determine the cost.

True/False:

Insurance premiums are based on the policyholder’s credit score. (True/False)

These questions test knowledge but also the ability to communicate complex information.

You can also generate questions automatically using OnlineExamMaker Question Generator, just input topics about insurance, then our system can generate questions in seconds.

Step 2: Customize assessment

After your skills assessment is created, OnlineExamMaker allows you to determine parameters like time limits, the order of questions, and difficulty or easy levels. Mix easy and challenging questions. This will serve better in assessing the overall competence of a candidate.

Step 3: Setting scoring

You can define how many points each question is worth, and set pass score for your insurance skills assessment. OnlineExamMaker also supports negative score when a candidate give a wrong answer.

Step 4: Publish and share exam link

You can share the link of the test to the candidates who can then assess any device connected to the internet. Your candidates can access the assessment by clicking a direct link or scanning a QR code.

Step 5: Analyze results

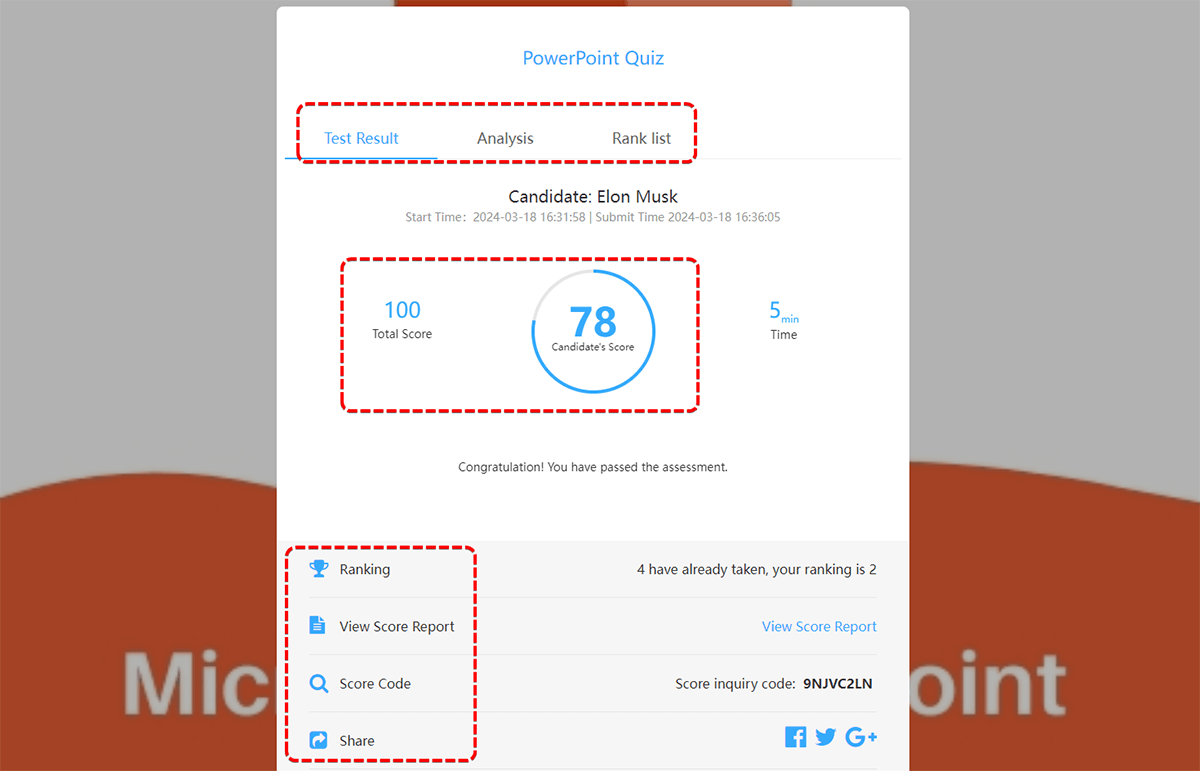

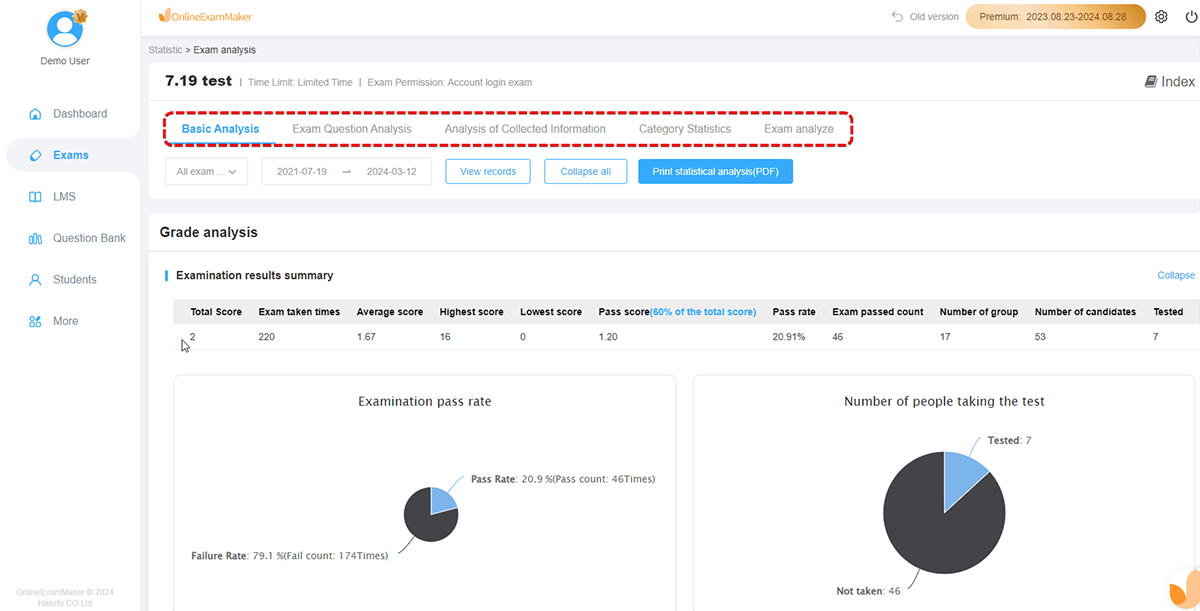

As participants complete the quiz, you can monitor their scores and responses through the OnlineExamMaker dashboard. It makes the selection process easier in choosing the best among them with the required skills.

To hire an appropriate insurance agent for the job, a candidate’s skills and knowledge need to be assessed. Emphasize what concerns both hard and soft skills, including product knowledge, regulatory understanding, communication, and sales abilities; this way, you will be guaranteed that the hired agent will perform as expected.

OnlineExamMaker allows you to create a unique assessment of these skills to make the hiring process faster and more effective. This helps you ensure that your new hire will be an outstanding performer in serving clients and contributing to the success of your organization.