In an era of complex financial systems and digital transactions, banking knowledge has become a vital life skill. Educators play a crucial role in equipping students with the financial literacy they need to navigate the banking world effectively. One powerful tool in achieving this is the use of banking knowledge assessments.

Table of content

- Part 1: 5 Creative Banking Knowledge Assessment Ideas

- Part 2: OnlineExamMaker: All-in-one Banking Knowledge Assessment Platform

- Part 3: How to Make A Banking Knowledge Assessment in OnlineExamMaker

5 Creative Banking Knowledge Assessment Ideas

Assessing Banking Fundamentals

A. Assessing Understanding of Basic Banking Terms and Concepts

A strong foundation in banking terminology and concepts is essential. To assess this knowledge:

1. Multiple-Choice Quizzes on Banking Terminology: Create quizzes that test students’ familiarity with terms such as “interest rate,” “savings account,” and “debit card.” Multiple-choice questions make it easy to gauge their comprehension.

2. Matching Exercises for Key Banking Terms: Use matching exercises where students must correctly pair terms with their definitions. This reinforces their understanding of banking terminology.

Just to let you know

Sign up for a free OnlineExamMaker account to create a banking assessment in minutes – automatic grading & mobile friendly.

B. Evaluating Knowledge of Different Types of Bank Accounts

Bank accounts serve as the cornerstone of personal finance. To assess students’ knowledge of various account types:

1. Short-Answer Questions on Various Account Types: Present students with short-answer questions that require them to explain the differences between savings accounts, checking accounts, and certificates of deposit (CDs), highlighting their unique features and benefits.

2. Case Studies on Choosing the Right Account: Provide case studies in which students must analyze individuals’ financial goals and recommend the most suitable bank account types. This encourages critical thinking and practical application of banking knowledge.

Testing Financial Transactions

A. Assessing Skills in Conducting Common Banking Transactions

Proficiency in conducting everyday banking transactions is crucial for financial independence. To assess these skills:

1. Simulated Online Banking Exercises: Create simulated online banking platforms where students can perform transactions like depositing checks, transferring funds, and paying bills. Monitor their ability to navigate the platform and complete transactions accurately.

2. Problem-Solving Tasks Related to Transactions: Present students with real-life scenarios involving common banking transactions and ask them to identify and solve any issues that may arise. This assesses their problem-solving abilities in a banking context.

B. Evaluating Knowledge of Online Security and Fraud Prevention

In today’s digital age, online security is paramount. To assess students’ knowledge in this area:

1. Scenario-Based Questions on Online Security Best Practices: Pose scenarios related to online banking security, such as recognizing phishing emails or securing personal information. Assess their ability to identify security threats and implement best practices.

2. Identifying Phishing Attempts and Fraud Scenarios: Present students with potential phishing emails or fraudulent scenarios and ask them to identify warning signs and suggest appropriate actions to take. This assessment tests their ability to spot potential threats and protect their financial assets.

Credit and Loans Assessment

A. Assessing Understanding of Credit Concepts

Credit is a significant aspect of personal finance. To assess students’ grasp of credit concepts:

1. Multiple-Choice Questions on Credit Scores and Reports: Develop multiple-choice questions that explore topics like credit scores, credit reports, and factors affecting creditworthiness. This assesses their knowledge of how credit works.

2. Calculations of Interest and Loan Repayment Scenarios: Challenge students to calculate interest on loans and create loan repayment plans. This hands-on approach ensures they understand the financial implications of borrowing.

B. Evaluating Knowledge of Different Types of Loans

Understanding various loan types and their implications is crucial. To assess this knowledge:

1. Matching Exercises for Loan Types: Create matching exercises where students must correctly match loan types (e.g., personal loans, mortgages, student loans) with their respective characteristics and terms.

2. Analyzing Loan Terms and Conditions in Case Studies: Present case studies involving different types of loans and ask students to analyze the terms and conditions. This assesses their ability to evaluate loan offers critically.

Investment and Savings Assessment

A. Assessing Knowledge of Investment Options

Investing is a key aspect of building wealth. To assess students’ understanding of investment options:

1. True/False Questions on Various Investment Vehicles: Create true/false questions that cover topics like stocks, bonds, mutual funds, and retirement accounts. This helps gauge their knowledge of different investment vehicles.

2. Portfolio Management Exercises: Challenge students to construct and manage investment portfolios. Assess their ability to diversify investments and make informed decisions based on risk tolerance and financial goals.

B. Evaluating Understanding of Savings Strategies

Savings strategies are essential for financial stability. To assess knowledge in this area:

1. Multiple-Choice Questions on Savings Accounts and Retirement Plans: Develop multiple-choice questions that focus on savings options like savings accounts, certificates of deposit (CDs), and retirement accounts. Test their comprehension of these financial tools.

2. Case Studies on Creating a Diversified Savings Plan: Present case studies involving individuals with different financial goals, such as saving for a home, education, or retirement. Challenge students to create diversified savings plans tailored to each person’s needs.

Continuous Improvement

A. Analyzing Assessment Results

After conducting banking knowledge assessments, it’s crucial to analyze the results:

1. Collating and Analyzing Assessment Data: Collect and organize assessment data to identify areas where students excel and areas that need improvement. This data-driven approach informs subsequent teaching strategies.

B. Adapting Teaching Strategies

Use assessment results to adapt teaching methods:

1. Using Assessment Results to Inform Teaching Methods: Tailor instruction to address specific knowledge gaps identified in the assessments. This ensures that teaching aligns with students’ needs and improves learning outcomes.

C. Encouraging Financial Literacy Initiatives

Promote financial literacy initiatives within your educational institution:

1. Promoting Financial Literacy Programs and Resources: Advocate for the incorporation of financial literacy programs and resources in your curriculum or institution. These initiatives can help reinforce banking knowledge and skills.

2. Creating a Culture of Lifelong Financial Learning: Encourage students to view banking knowledge as an ongoing journey. Foster a culture of lifelong financial learning, where students continue to enhance their financial literacy beyond the classroom.

OnlineExamMaker: All-in-one Banking Knowledge Assessment Platform

OnlineExamMaker is a user-friendly online assessment and quiz platform that simplifies the creation and delivery of interactive web quizzes, tests, and surveys. With its customizable design, interactive features, and real-time feedback capabilities, OnlineExamMaker empowers educators, trainers, and organizations to engage their audience and assess knowledge effectively.

Key Features

Randomize Questions: You can prevent cheating by randomizing questions or changing the order of questions, so learners don’t get the same set of questions each time.

Disabled Activities: Configure the exam setting to prevent printing activities, cut-copy-paste commands and browser extension activities (such as Google Translate).

Teamwork: From question creation, candidate management, certificate design, grading to uploading courseware, you can assign different tasks to each team member.

Create Your Next Quiz/Exam with OnlineExamMaker

How to Make A Banking Knowledge Assessment in OnlineExamMaker

Step 1: Sign up or login >

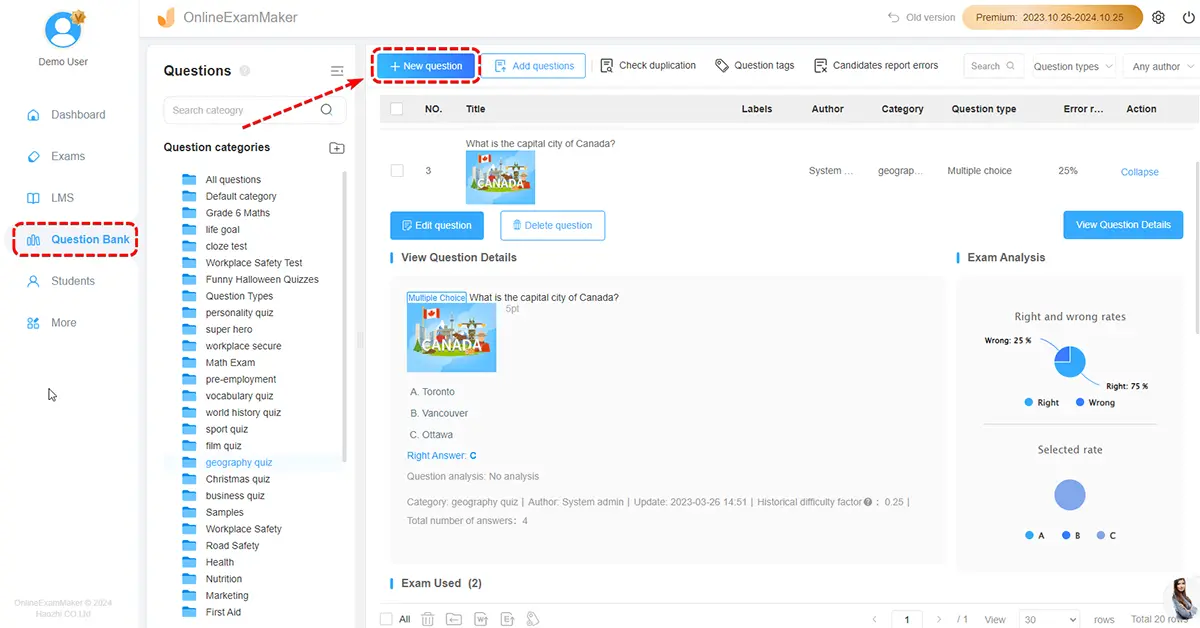

Step 2: Upload banking questions in bulk or edit questions in our Question Editor.

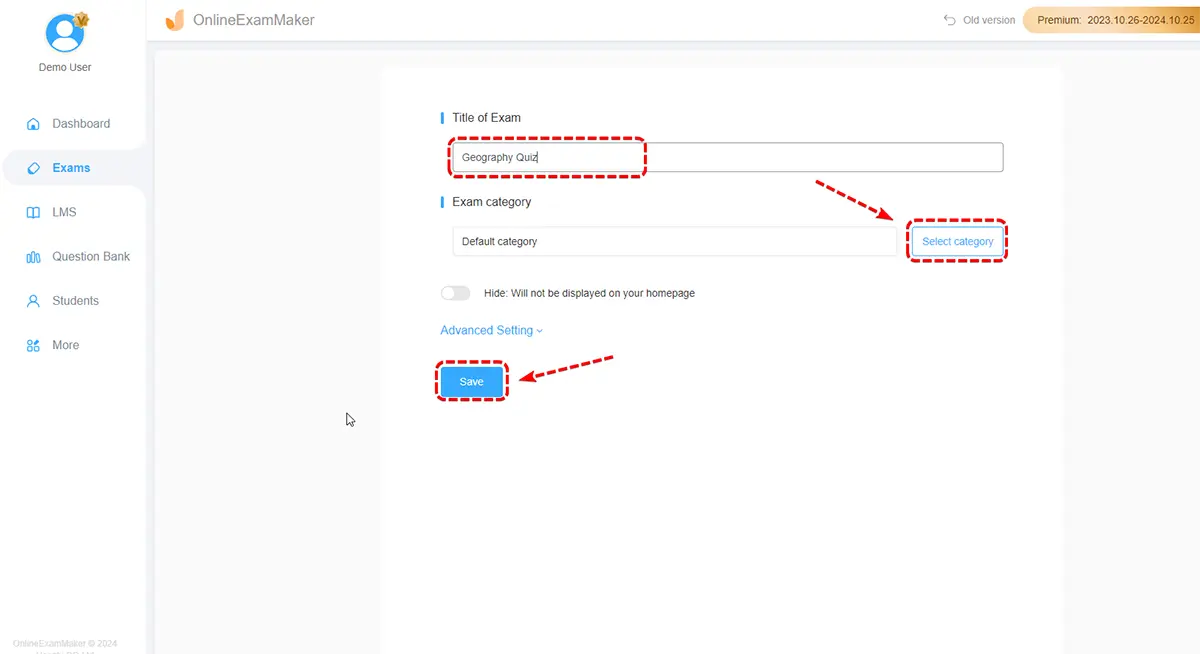

Step 3: Create a new quiz, fill basic information, then personalized settings.

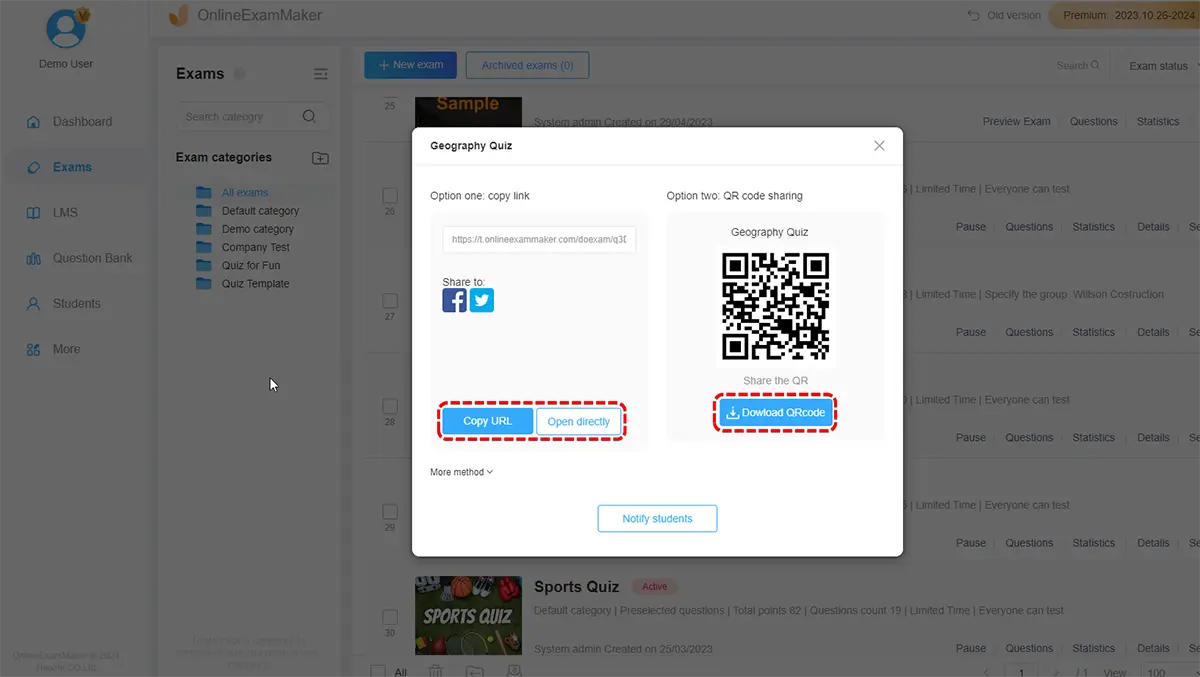

Step 4: When you’re ready for students to take the quiz, click “Publish” button to make the assessment live.

Conclusion

Effective banking knowledge assessments are essential for equipping students with the financial literacy they need to navigate the modern banking landscape. By implementing these assessment ideas, educators can empower students to make informed banking decisions, manage their finances effectively, and build a secure financial future. Banking knowledge assessments should be viewed not only as evaluative tools but also as instruments for promoting financial empowerment and responsible financial behavior.